TL;DR / At-a-Glance Summary

The smart city connectivity market is projected to grow at 18.7% CAGR, reaching over $200B by 2030, with IoT MVNOs capturing 18-21% CAGR growth—more than double the traditional MVNO market rate.

The MNO Gap: Traditional Mobile Network Operators (MNOs), with their rigid, consumer-focused models, are ill-equipped to provide the flexible, cost-effective, and specialized smart city connectivity required for diverse urban IoT applications.

MVNOs have an advantage over MNOs: In urban IoT deployments through flexible pricing, multi-carrier aggregation, specialized platforms, and the ability to customize security and service levels for mission-critical applications, enabling scalable deployments across transportation, utilities, and public safety sectors.

Four core verticals dominate smart city opportunities: Intelligent Transportation, Smart Utilities, Public Safety, and Environmental Management, each requiring distinct connectivity approaches.

The Platform Imperative: Success is no longer about selling raw connectivity. The future lies in ascending the value chain with platform-based services, including advanced security, device lifecycle management, and data analytics that address critical municipal challenges.

As 5G, eSIM, and AI converge, MVNOs are uniquely positioned to fuel smart city growth by enabling scalable, secure connectivity for IoT networks — from traffic systems to utilities. In 2025, MVNOs can pivot beyond data reselling, bundling contextual services like analytics, device management, and vertical-focused solutions to unlock new urban revenue streams.

Why 2025 Is a Breakout Year for Smart City Connectivity

By 2025, the idea of a smart city has matured from pilot projects into connected, data-driven urban ecosystems.

Over half the global population already lives in cities, and this will rise to 68% by 2050, driving continuous investment in digital infrastructure.

Cellular IoT now serves as the foundation of smart city connectivity. Global connections passed 4 billion in 2024, led by NB-IoT, LTE-M, Cat-1 bis, and 5G RedCap. As of 2024, 258 operators across 68 countries had deployed LPWA networks, expanding the global footprint for low-power, wide-area coverage.

Cities are moving from pilots to large-scale rollouts across utilities, transport, waste, air quality, fleets, and surveillance. Each use case demands specific performance — deep coverage, long battery life, low latency, mobility, and secure isolation for critical systems.

The challenge is clear: managing millions of IoT devices that act as an urban nervous system requires secure, reliable, and tailored connectivity. Traditional Mobile Network Operators (MNOs), built for mass-market users, struggle to meet these diverse needs.

Mobile Virtual Network Operators (MVNOs) are emerging as the key enablers of this transformation, offering flexibility, multi-carrier reach, and customized services that make scalable smart city connectivity a reality.

Why Smart City Connectivity Requires More Than a Standard MNO

Smart cities demand flexible, optimized connectivity, not a one-size-fits-all approach. Here’s why standard MNOs struggle to meet the needs of urban IoT—and how specialized MVNOs fill the gap.

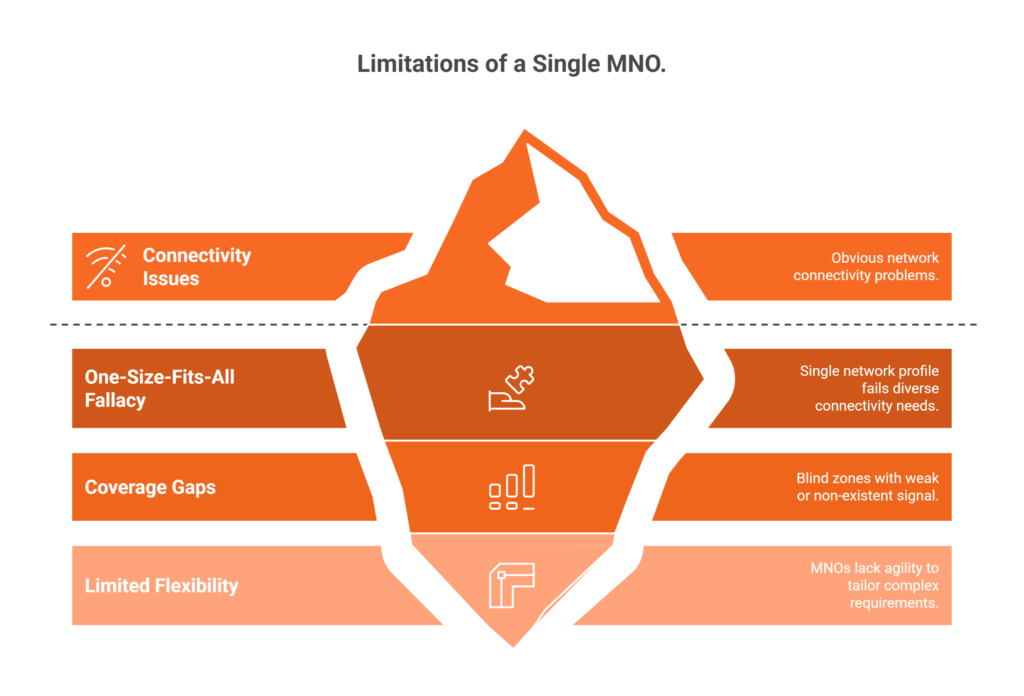

The Limitations of a Single MNO

1. “One-Size-Fits-All” Fallacy

A single MNO can only offer one network profile. But in a city, connectivity needs are highly varied. A smart water meter deep in a basement demands deep indoor coverage (e.g. NB-IoT), while a public safety drone requires high bandwidth, ultra-low latency, and reliable mobility—capabilities unmatched by a one-network solution.

2. Coverage Gaps & Not-Spots

Even the best MNOs have blind zones. From urban canyons and underground tunnels to expansive parks and remote edges, areas will always exist where signal strength is weak or non-existent.

3. Limited Flexibility

Municipal systems often need custom procurement, tiered billing, segmented management, and strict service-level guarantees. Large MNOs typically lack the agility or willingness to tailor offerings to these complex, diverse requirements.

Connecting the Dots

Municipalities can no longer hinge smart city strategies on consumer-grade network models. Today’s infrastructures require multi-network orchestration, modular architectures, and tailored service layers to meet use-case diversity reliably.

That is exactly where specialized IoT MVNOs shine. By layering control, orchestration, and differentiated SLAs over multiple network resources, they offer resilient, use-case-tuned connectivity that enables scalable, city-wide smart infrastructure.

Why MVNOs Win in Smart City Connectivity

Traditional MNOs own the physical network infrastructure but are fundamentally misaligned with smart city requirements. Their business models are optimized for high-volume consumer services—smartphones, voice, and video—not the diverse, often low-ARPU, mission-critical needs of millions of urban sensors and devices.

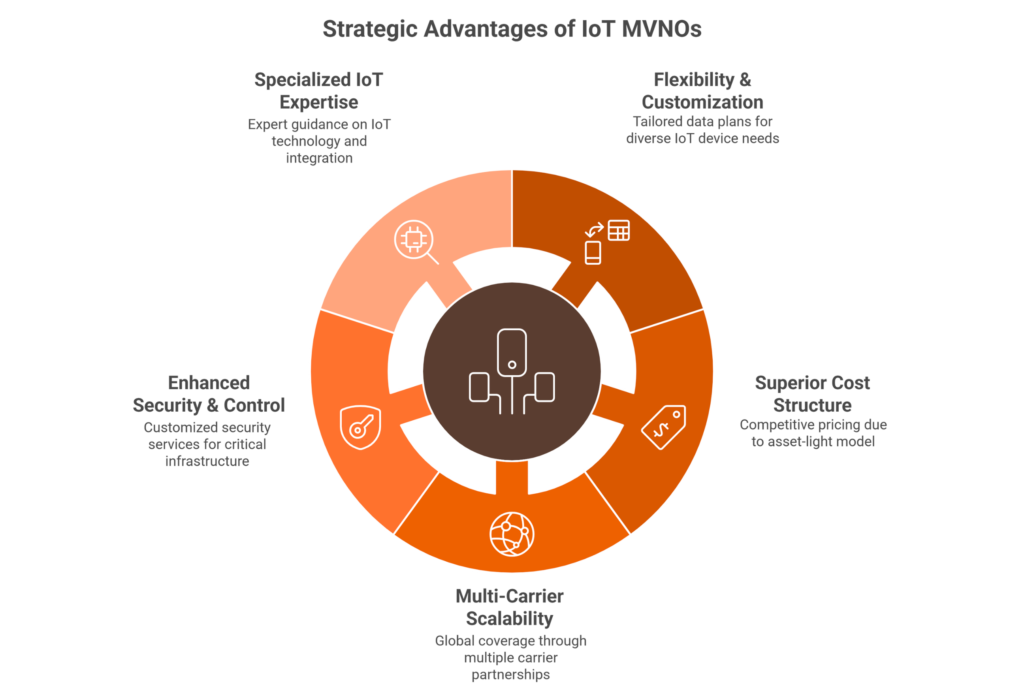

Specialized IoT MVNOs Offer Five Strategic Advantages

1. Flexibility & Customization at Scale

MNOs typically offer standardized, high-volume data plans designed for smartphones. IoT devices in smart cities have vastly different usage patterns—a parking sensor might use kilobytes per day, while a surveillance camera requires gigabytes. IoT MVNOs excel at creating tailored plans: data pooling across device fleets, low-cost tiers for bandwidth-constrained applications, and pay-per-use models that prevent municipalities from overpaying for unused capacity.

2. Superior Cost Structure

MVNOs operate on an asset-light model, leasing capacity from MNOs at wholesale rates rather than bearing the capital and operational expenditure of building and maintaining physical network infrastructure. This allows significantly more competitive pricing—critical for massive-scale deployments like smart metering where per-device economics determine project viability.

3. Multi-Carrier Global Scalability

While MNOs are typically restricted to their national network footprint and predefined roaming partnerships, many IoT MVNOs pursue a multi-carrier strategy, aggregating wholesale access from numerous MNOs globally. They can offer single SIM or eSIM solutions that connect to the strongest available network in any location, providing superior coverage resilience and simplifying logistics for system integrators deploying across multiple cities or countries.

4. Enhanced Security & Control

Full MVNOs operate their own core network infrastructure, including HLR/HSS, GGSN/PGW, and billing systems, while leasing only the Radio Access Network from MNO partners. This architecture enables customized security services: private networks using dedicated APNs, end-to-end VPN encryption, and granular control over data routing and traffic policies—capabilities essential for securing critical urban infrastructure like energy grids and public safety networks.

5. Specialized IoT Expertise

MNO customer support is structured for consumer handset issues and lacks the specialized expertise required to troubleshoot complex IoT deployments. IoT MVNOs provide expert guidance on device certification, firmware management, API integration, and M2M communication protocols, acting as true technology partners rather than commodity vendors.

MNO vs. IoT MVNO Comparison for Smart City Deployments

| Feature | Mobile Network Operator (MNO) | Specialized IoT MVNO |

|---|---|---|

| Cost Model | Higher operational costs; less flexible pricing | Variable cost model; competitive IoT pricing |

| Data Plans | Standardized consumer plans | Highly customizable (pooled, tiered, pay-per-use) |

| Global Coverage | Single network + fixed roaming | Multi-carrier aggregation; single SIM/eSIM |

| Security Control | Standard network security | Custom private networks, VPNs, security policies |

| Scalability Management | Manual/portal-based | API-driven platform for automated provisioning |

| Technical Support | Consumer-focused | Specialized M2M and IoT expertise |

| Time-to-Market | Bureaucratic, slow adaptation | Agile, rapid custom solution deployment |

Four High-Value Smart City Verticals for MVNOs

1. Intelligent Transportation & Mobility

The automotive and transportation vertical holds the largest IoT MVNO revenue share at 28.54% in 2024, driven by connected vehicles, fleet management, and traffic optimization systems.

Key Use Cases:

- Real-time traffic monitoring with dynamic signal adjustment to alleviate congestion; smart parking systems that reduce the 40% of city traffic caused by parking searches

- Connected public transport for fleet management, predictive maintenance, and passenger information

- EV charging station connectivity for billing and grid load management

- Vehicle-to-Everything (V2X) communication for accident prevention

MVNO Opportunity: This vertical demands a portfolio approach—NB-IoT for static parking sensors, LTE-M for mobile fleet tracking with seamless handover, and 5G URLLC for critical real-time applications like V2X and intelligent traffic control.

2. Smart Utilities & Energy Grids

Energy and utilities is the fastest-growing IoT MVNO vertical, with a projected 22.32% CAGR, fueled by massive-scale smart meter and grid deployments.

Key Use Cases:

- Advanced Metering Infrastructure (AMI) for electricity, water, and gas—eliminating manual readings and enabling accurate billing and leak detection

- Smart grid management for real-time fault detection, load balancing, and renewable integration

- Smart street lighting with remote monitoring and dimming based on conditions, delivering 35%+ energy savings. Over 161 million cellular-connected lights are expected by 2027

MVNO Opportunity: The defining characteristic is massive scale at ultra-low cost. NB-IoT is ideal, offering deep building penetration to reach basement meters and battery life up to 10 years. Success requires platform services for lifecycle management and data aggregation, positioning the MVNO as a strategic partner in utility digital transformation.

3. Public Safety & Security

This “Critical IoT” vertical commands premium pricing due to mission-critical reliability requirements.

Key Use Cases:

- City-wide HD video surveillance networks, often AI-enhanced for real-time incident detection

- Acoustic gunshot detection sensors for instant triangulation and police dispatch

- Real-time communication and data access for first responders, integrated into command and control platforms

MVNO Opportunity: The Secure MVNO (S-MVNO) model leverages commercial LTE/5G networks but provides public safety agencies with mission-critical services including prioritized and preemptive network access, ensuring communications succeed even when public networks are congested during disasters. This requires advanced 5G capabilities like network slicing and URLLC—a prime opportunity for Full MVNOs with technical control over core network policies.

4. Environmental Monitoring & Resource Management

Driven by sustainability mandates and public health concerns, cities are deploying extensive sensor networks.

Key Use Cases:

- Air quality and water quality monitoring for particulate matter, NO2, and pollutants

- Smart waste management with ultrasonic fill-level sensors optimizing collection routes, reducing fuel consumption and emissions by up to 80%

- Structural health monitoring of bridges, tunnels, and buildings with embedded sensors detecting stress and corrosion for predictive maintenance

MVNO Opportunity: Sensors deployed in challenging outdoor or underground environments need years of battery-powered operation, making LPWAN technologies like NB-IoT and LTE-M ideal. The key value proposition is bundling connectivity with analytics platforms that generate actionable intelligence—optimized sanitation routes or pollution alerts—transforming the MVNO from data transporter to intelligence partner.

Technology Enablers: The MVNO Connectivity Portfolio

Smart city use cases span a vast spectrum of requirements—from ultra-low-power sensors transmitting kilobytes monthly to high-definition cameras streaming gigabytes daily. A successful IoT MVNO must master and offer a sophisticated portfolio of connectivity options, managed through a unified platform, selecting the optimal technology for each application based on bandwidth, latency, power consumption, and cost.

Technology Matrix for Urban IoT Applications

| Technology | Data Rate | Latency | Mobility | Battery Life | Ideal Smart City Use Cases |

|---|---|---|---|---|---|

| NB-IoT | ~26–127 Kbps | 1.6–10 sec | Static only | 10+ years | Smart metering, parking sensors, environmental monitoring |

| LTE-M | ~1 Mbps | 10–20 ms | Full handover | Multi-year | Fleet tracking, asset management, wearables, connected health |

| 5G RedCap | 150–220 Mbps DL | ~10–20 ms | Full handover | Medium | HD surveillance, industrial sensors, advanced wearables |

| 5G URLLC/eMBB | Multi-Gbps | <1–5 ms | Full handover | High | V2X, autonomous vehicles, remote control, critical public safety |

How Spenza Enables MVNOs to Orchestrate & Scale City Programs

Spenza is an operator-neutral connectivity enablement platform that unifies procure-to-pay, multi-operator marketplaces, eSIM orchestration, billing, and compliance—designed so MVNOs and brands can launch and scale quickly.

Think “Stripe + Shopify for connectivity.”

What this means for smart cities and urban IoT:

- Rapid Launch: No-code MVNE platform integrated with e-commerce capabilities enabling MVNOs and system integrators to launch branded smart city connectivity offerings in days, not months

- Multi-Operator Orchestration: “Bring Your Own Network” (BYON) support plus marketplace access to pre-negotiated operator plans, unified in a single management pane

- Compliance-by-Design: Pre-integrated tax and regulatory frameworks, particularly for complex US markets

- End-to-End Automation: From device provisioning and activation to billing, payment processing, and L1 support ticketing

- API-First Architecture: Enabling seamless integration with smart city platforms, OEM device management systems, and municipal data infrastructure

For MVNOs and system integrators, Spenza eliminates the need to build complex connectivity management infrastructure, allowing focus on core value-added services and customer relationships. For municipalities and smart city solution providers, it enables working with agile, specialized connectivity partners rather than being locked into inflexible MNO contracts.

Conclusion: Smart City Connectivity is an MVNO Game to Win

As cities scale from pilots to platforms, connectivity must be heterogeneous, programmable, and outcome-aligned. MVNOs, especially those with full-core control, eSIM mastery, and CMP automation, are uniquely positioned to deliver on this brief in 2025 and beyond—faster, cheaper, and safer than single-operator models.

Spenza is purpose-built to help MVNOs lead: operator-neutral aggregation, eSIM (SGP.32) orchestration, billing/compliance, and no-code commercialization that gets you from RFP to revenue in days.

For MVNO executives, system integrators, and smart city leaders, the question isn’t whether to embrace this opportunity, but how quickly you can build the platform capabilities to capture it.

FAQs

MNOs focus on the mass consumer market with standardized, high-volume data plans that are inefficient and costly for low-data IoT devices. Their model lacks the flexibility for custom security and the specialized support needed for complex smart city projects.

The biggest growth areas are Intelligent Transportation, which holds the largest revenue share, and Smart Utilities, the fastest-growing vertical driven by smart metering and lighting. Public Safety is also a key vertical, requiring high-performance connectivity for video surveillance and first responder communications.

“Massive IoT” refers to large-scale deployments of simple devices, like smart meters, where low cost is the primary driver. “Critical IoT” involves applications like public safety communications where high reliability, low latency, and robust security are paramount.

Spenza provides a “single pane of glass” to manage complex, multi-vendor smart city deployments. Its operator-neutral platform allows MVNOs to easily procure connectivity, control operations, and monetize services, simplifying the orchestration of municipal IoT.

Ready to Power Your Smart City Vision? Request a free demo and see how quickly you can launch, scale, and deliver ROI across lighting, meters, mobility, and public safety.