A typical mid-sized enterprise receives tens of invoices from multiple operators every month. Tracking the spend and paying the bills on time is a tedious task that falls on the most overworked personnel in the HR, finance, and operations teams. With Spenza, you can now track all operator invoices in one place and pay with a single bill. You save time, optimize spend, and also save on late charges!

Spenza allows you to maintain a credit balance in your account, ensuring you can seamlessly purchase plans, manage subscriptions from multiple operators, and pay all your bills on time to keep your operations running smoothly. This is an ideal solution for business expense management, simplifying the entire process and helping your team stay on top of expenses.

This guide explains how to top up an account.

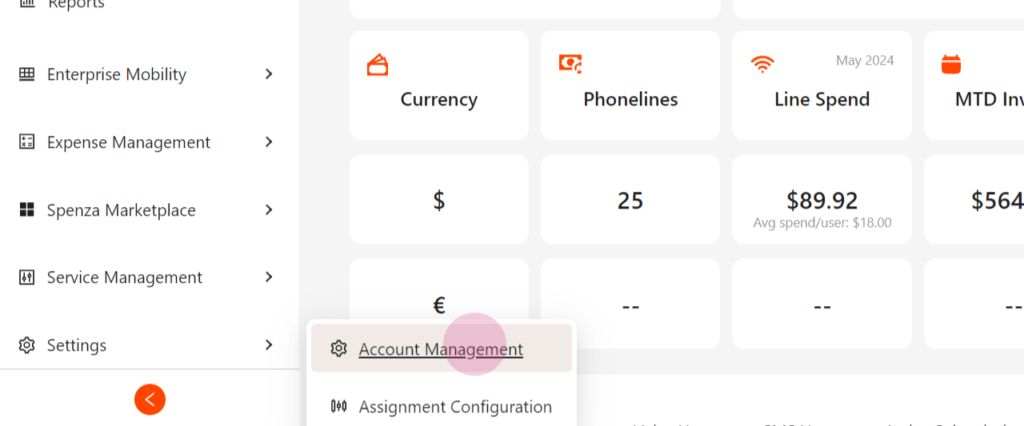

Step 1: Start by navigating to Settings and Account Management.

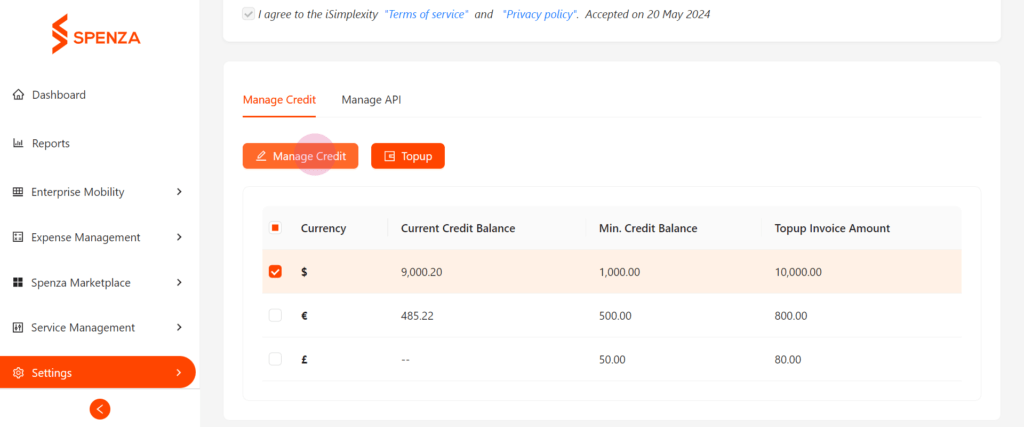

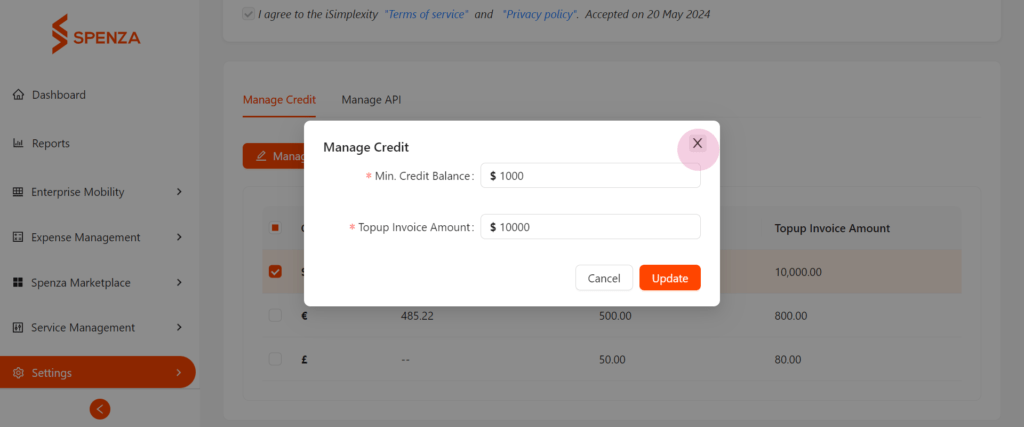

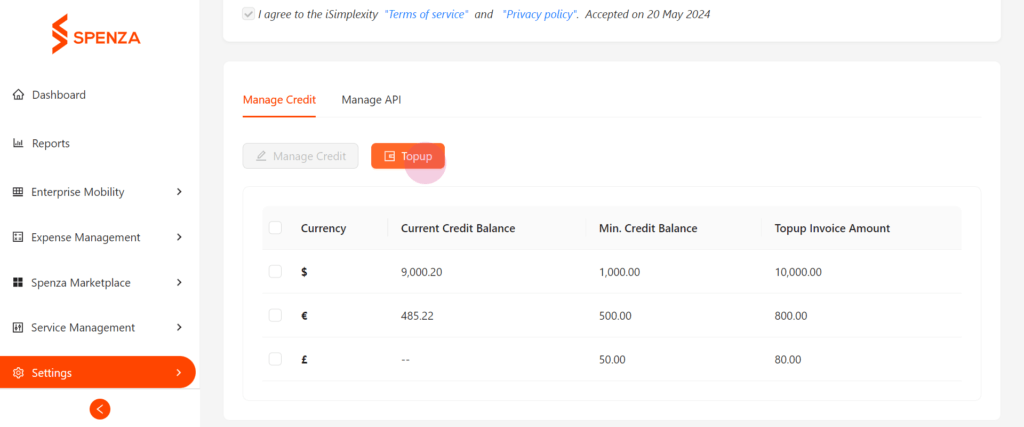

Step 2: Scroll to the top up section. Here, you can maintain a top up amount for all the different for different currencies. To manage the credit balance and top of invoice amount configuration, you can simply select and click on “Manage Credit”.

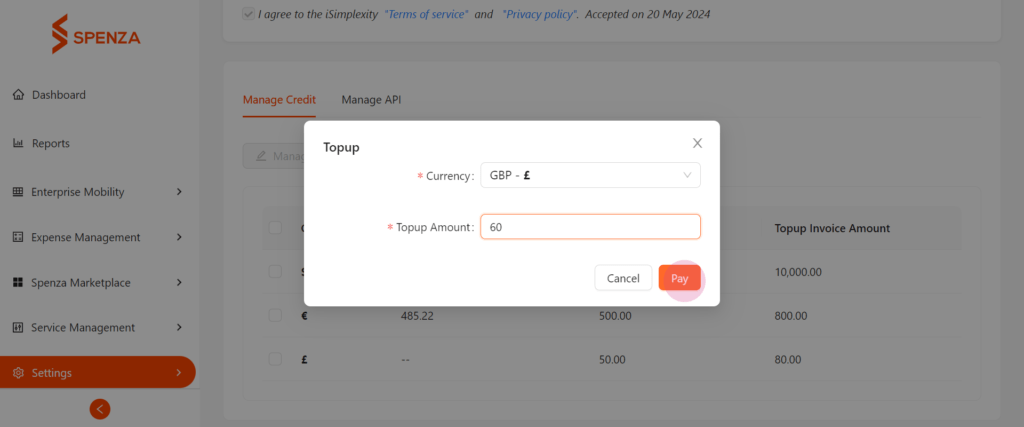

Step 3: To add a top up amount, simply click on top top up, enter select the currency from the drop down and enter the top up amount and click on “Pay”. You will be redirected to the payment page.

On successful payment, the top-up amount will reflect in your account under the current credit balance. Some amount is deducted in processing transactions through a card. This top-up process allows for quick payments at a later stage, further optimizing your business expense management and helping you maintain an efficient workflow for managing subscriptions.

Here are the suggested sections for Benefits of Using Spenza for Business Expense Management and Tips for Effective Business Expense Management:

Benefits of Using Spenza for Business Expense Management

Using Spenza for your business expense management offers several key benefits that can help streamline your financial processes and improve operational efficiency:

- Centralized Invoice Management: Another advantage of using Spenza is that all operator invoices can be received and processed in one document, leaving no need to work with numerous papers and applications.

- Time-Saving and Efficiency: This reduces the time and effort required for your Human Resource, finance and operations team to handle top-ups and payments manually.

- Reduced Late Payment Fees: In a way, a positive balance will allow you to avoid such things as additional charges due to late payments, which sometimes result in penalties or suspension of services.

- Improved Cash Flow Management: Through credit control, you can set a credit balance right from the get-go to centralize command over your corporation’s cash flow-ensuring you have the adequate funds to make the payments while at the same time, properly monitor spend.

- Seamless Integration with Subscriptions: With Spenza you can take full subscription management from one or multiple operators and service providers to multiple sectors of your business.

Tips for Effective Business Expense Management

To maximize the potential of your business expense management with Spenza, consider these practical tips:

- Set a Regular Top-Up Schedule: Develop time and frequency to top up your Spenza account in relation to the recurrent expenses of your business. This will allow you to always compile enough money to cater for subscriptions and invoices to prevent situations where you find yourself looking for the money at the last minute.

- Monitor Your Credit Balance: Learn the correct amount to credit your account to so that you do not spend all the cash on other aspects of life. Make sure to set alerts or reminders that tell you it is time to top up your balance so that you do not develop a situation where your payments are interrupted.

- Track Expenses by Category: Take advantage of the features available in Spenza so that it becomes easier to group your expenses in order to understand where the money is being spent. This can be useful in determining whether costs can be cut or at least managed in some of the processes you engage in.

- Automate Payments When Possible: Explore other automated payment options available through Spenza since it will help to minimize the efforts to be made while dealing with subscriptions and paying invoices. It reduces the possibility of error and guarantees that your payments will be made within the right time.

- Review Monthly Reports: Invest time and effort in reviewing your expense reports so you can get an idea on which you should focus when it comes to top-ups. This will assist you in making a much sound decision for the financial aspect of the business.

By following these tips, you can streamline your business expense management process, save time, and ensure your operations run smoothly without the hassle of missed payments or unnecessary delays.

To add more cash in your Spenza account, follow the steps in the Setting & Account Management. Go to the top up section where you can choose the currency and type the amount of money that you want to top up. Following that, click the “Pay” button to take you to the payment page. After the payment is successfully made the amount will be reflected in the current credit balance. This will make sure that you have a good balance of business capital so that you meet all your payment deadlines and then ensure that you are able to meet all your business expenses charged in the form of subscriptions, invoices etc.

Spenza is open for secure payment methods, which is nebulas, credit cards and debit cards. If you want to choose the amount of top-up and currency, you will be transferred to the payment options’ page where you can select the payment method. Top-up requires that your payment details should be accurate and capable of supporting the top-up amount. There are small processing fees involved in some of the transactions more so when accepting cards as mode of payment. Worrying about getting your payment done in a reliable manner also allows your top-up process to go through so you can continuously operate your business expenses without having to slow down.

To check the current credit balance with the Spenza account, go to Account Management. Here your current available balance of credit you can view by going to the option of “Current Credit Balance”. This balance shows you the amount of money you have to spare or lack to meet the various invoices and other subscriptions you have. You should also monitor the balance of your account to avoid having little balance and make some payments in time. It is important because having enough balance would mean less interruption in all your business expenditures and everything would be in order.

Yes it is possible to top up through a Spenza account in any currency of your choice. To top up, you have to select the currency from a dropdown menu followed by the amount to be topped up. This feature is particularly useful for companies, which have their divisions in different countries so it would allow them to track invoices and subscriptions in different regions. By having a credit balance in different currencies you make international business expenses easier to handle and are guaranteed a smooth processing of your payments without delays caused by conversion or additional fees.

If you fail to complete payment during the top-up process, the first thing you should do is to verify the card or your payment details. Other emerging problems are old cards, lack of adequate amounts, or wrong details. However, if the issue continues, consider using another payment method or to contact Spenza’s support service. This means that if there is a failed payment, you will not see this in your account credit balance and you cannot make your subscriptions or your bills. This is very important in avoiding complications in business expenses hence avoiding delaying payments.